It’s mental: Why remote resorts are resisting renewable energy

Daniel Rye develops renewable energy microgrids for remote applications, including at hotels and resorts. In this “GT” Insight, Daniel discusses the psychology behind common objections decision makers have against an increasingly efficient and economical energy option.

Renewable energy is here. By empirical metrics this is undeniable. For example, 2015 was the first year that saw renewables account for the majority of incremental global power generation capacity — 134 GW, making up 53.6% of the total (new capacity). And that doesn’t even include hydro power.

In the seven years that I’ve spent developing renewable energy (RE) projects in Asia, a lot has changed. RE used to be a ‘nice to have’ where the early adopters chose to ignore the shaky business case — and the opportunist solution providers — in exchange for doing the right thing. Today it’s an entirely different landscape where the business case is almost always a ‘no-brainer’ and the technology and solutions are mature and well understood.

With my current work at Canopy Power in Singapore, I help develop and implement renewable energy microgrids for businesses and communities located in remote locations across Southeast Asia. These places traditionally rely on diesel generation or a poor-quality grid for their electricity.

Interestingly, hospitality forms the vast majority of our project client base. So why are resorts apparently adopting RE more than any other remote industry?

- Business is booming and the industry is growing rapidly. These clients are about as likely as any to be able to afford investment in renewable energy infrastructure.

- Transitioning to eco-resort status or gaining green credentials can justify an increase in room rates, enabling top-line growth. Other industries do not have this positive feedback mechanism.

The industry seemingly has a conscience about its impact on the world. It is a large contributor to global carbon emissions but is self-reflective enough to realise it and do something about it — as evidenced by the incredibly aggressive carbon emission target it has set itself.

Perhaps this is not entirely altruistic, given hospitality often relies heavily on things like islands not sinking, air being breathable, and pristine environments being preserved.

So, despite a clear business case, and hospitality having intrinsic incentives, the rate of adoption is still at a snail’s pace. Is this a mystery or is it entirely predictable based on human psychology?

Warren Buffet’s right-hand man, Charlie Munger, framed 25 tendencies of human misjudgement in relation to investment decisions. When I stumbled upon this work, some of these tendencies resonated with what I have experienced while developing renewable energy projects. I decided it’s time to highlight them and try to combat them head-on.

Here I analyse what I consider the five most powerful tendencies that I encounter and how they can be rationalised:

The Liking / Loving Tendency

“We ignore the faults of people, products or companies that we admire.”

Our electricity supply enables so much convenience. It also brings to life much of what we find interesting while powering the growth of our businesses. Imagine our life without it. It would be devastating. While we might consciously complain about some aspects, be it the monthly bills or the constant noise, at the sub-conscious, we are in love.

What are we in love with exactly? The product or the means by which it is supplied? Some would say it is the product, but the reality does not support this. People often resist the simple change to a different utility provider, even in the face of clear benefits. Should our tendency to love apply to supplier and technology choice? Does this not inhibit our ability to make smart decisions when there are better options available?

Canopy Power’s existing clients used to put up with challenges that most people would assume were artefacts of the stone age. Logistics in getting fuel to site is one example. At island resorts, diesel is often brought in by the barrel every week. Typically, the delivery craft will anchor offshore and the resort’s dinghy will make multiple journeys to collect each barrel, before rolling each up the beach and onto trolleys to take them to the generator room. They even risk environmental damage when barrels of diesel fall into the sea. To give an idea of the quantities we are talking here, a smallish resort with a moderate average load of 100kW, needs to ship 24,000 litres of diesel to their island per month.

Another challenge is cost. In cities we are used to paying 10 cents to 20 cents (USD) for a unit of electricity (a kWh). In remote locations, the end-use cost of electricity, once fuel delivery and generator maintenance has been considered, is normally between 30 and 50 cents per unit. [1] A solar photovoltaic microgrid can offer levelised costs of energy (LCOE) in the region of 20 to 25 cents. [2]

On top of all of this, most resorts are trying to be pristine retreats for ultimate relaxation, yet they are forced to run noisy generators that chug out fumes 24/7. This doesn’t fit the picture that most tourists have in their minds before visiting.

Sometimes a divorce makes sense. Renewable energy significantly improves all of the conditions discussed. And the transition isn’t even that painful!

As a historical analogy, in the early 20th century, electric lighting was starting to be adopted. The hotels that stuck with oil and gas lamps while their competitors moved to electric lighting didn’t fare too well. The leap in safety that electric lighting brought, relative to its predecessor, meant most of the technology adoption cost was covered by the insurance savings. But the main benefit was the health improvements for customers! In the end, people voted with their feet. They wanted to stay in safer, healthier and cheaper hotels with the latest technology.

The Availability-Misweighing Tendency

“We overweigh what’s easily available.”

This tendency might lead to business-wise decisions if what we believe is easily available, is actually easily available. A grid connection that effortlessly powers everything in our home and business seems easily available. But the infrastructure and costs involved in generating and delivering that power to us is monstrous. And guess what? We pay for that. In remote places diesel generators seem like reliable, trusted work horses that keep on churning out all that lovely power right where it’s needed. But how available are the thousands of litres of diesel that must be shipped to site every month? And how available is that maintenance specialist or spare part that’s needed when there’s a break down?

This complexity and cost to ensure availability translates to an energy security issue which is a significant risk for any business that relies on a constant energy supply. Relying on processes and markets outside of our control while hoping for good weather on fuel delivery day, are all factors contributing to the next outage being a when, rather than an if.

We can compare this situation with renewable energy sources like wind or solar. The ‘fuel’ for these power sources is delivered to site by nature, for free every day of the year. Solar and wind energy are the most widely available free energy sources on the planet.

Let’s start overweighing that fact next time we’re evaluating a renewable energy installation.

The Doubt Avoidance Tendency

“If we are unsure about a decision we quickly remove any doubt by making an ill-informed, quick decision.“

I agree that doubt is to be avoided as much as possible when making investment decisions. But we need to be sure about why there is doubt. Is it because of objective evidence or because of inaccurate perception and misinformation?

Nowadays, most clients actually have very few doubts on technology risk. Most doubts arise from some knowledge about the intrinsic high capital expenditure that’s associated with most renewable energy technology. When we buy outright a solar or wind system, we are effectively paying for 20 years of electricity (240 monthly bills) on day one. This is a big challenge for most businesses. Luckily, we live in a highly financialised world, where nearly any asset can be paid for over time.

It took a while for financial institutions to understand the (relatively low) risks associated with collateralisation of renewable energy assets, but today financed solutions are the norm. For the off-taker (in our case, resort owners) this enables them to realise net energy cost savings from day one while also allowing certainty in cost forecasting, which is a major plus to a business.

Remote microgrids are a bit different though. They are often too small and too … well, remote, to attract the big financiers. To fill this gap, Canopy Power has developed a specialist microgrid financing product which allows clients to overcome the cost hurdle. Here the finance company actually procures, owns and maintains the microgrid and either sells electricity to the client on a long-term contract (known as a power purchase agreement), or leases the equipment to the client over some years until ownership is transferred.

Because the investors’ niche is in financing remote electrification projects, they have the ability to take on the risk that other investors would reject (due to The Doubt-Avoidance Tendency).

The key to minimising the risk of these remote projects lies in having a thorough due diligence process and high-quality solution design. A robust remote monitoring and control system is essential as part of this.

The Social Proof Tendency

“We tend to think and act like those around us. It’s the herd mentality.”

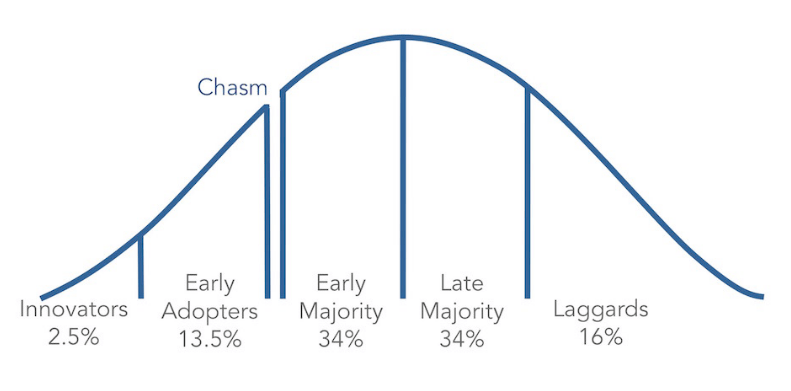

This one doesn’t need any explaining. We see it everywhere. Until a critical mass of people are doing something, the mainstream will not follow. I think this tendency is one of the drivers behind the shape of Rogers technology adoption bell curve.

As I alluded to in the opening, renewable energy adoption is happening. But Canopy Power’s clients in far-flung places may not have this perception. They still see everyone using diesel for power. So it is our job to highlight that the early adopters are growing even in these places.

The photos below show completed installations at three of Canopy Power’s clients’ sites. Four more are currently under construction. That’s a total of seven remote resorts in just one region adopting renewable energy from a solution provider with only seven employees. The social proof is here and it is growing.

In my opinion we are now approaching the chasm between early adopters and the early majority and I am optimistic we will cross that and see significant growth in the coming years.

Reward & Punishment Super-response Tendency

“The power of incentives.”

This is a ‘super-response’ tendency, meaning that it has extra power over us. Therefore, instead of trying to combat it, we will attempt to work with it to encourage adoption.

Here we focus on the positive incentives to adopt renewable energy in business and life. For example, by decreasing energy costs a resort can increase its gross operating profit per available room (GOP PAR) — a key business performance metric in hospitality.

Another huge incentive for resorts to adopt renewable energy is that it increases credibility with and exposure to the sustainable hospitality market. Eco-resort status can increase top line revenue generation through more premium rates and access to a new tourist demographic.

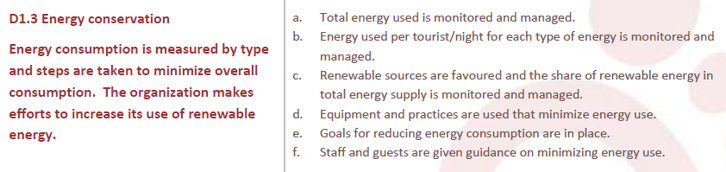

The Global Sustainable Tourism Council (GSTC) helps to formulate sustainability criteria for the industry. Today at least 31 sustainable tourism certifications agencies base their certifications on GSTC criteria. One of the key criteria in attaining certification is energy conservation (D1.3). All six of the sub-criteria (a. — f.) can be addressed by implementing a renewable energy microgrid.

On top of these there are the incentives to alleviate or eliminate some of the everyday issues that fly in the face of a resort’s paradise image, such as air pollution, noise, power unreliability and logistical pain.

Decision making is mental

Decision making is a mental process so it makes a lot of sense to understand some of the significant tendencies that may affect one’s clients. In this blog post we have looked beyond the face-value objections to the adoption of renewable energy, to analyse some of the fundamental drivers behind those objections. By harmonising one’s offerings to these psychological tendencies, we can, in theory, increase the chances of clients making the decision to adopt.

Featured image: Misool is a diving resort and conservation centre located in Raja Ampat, Indonesia. Misool was founded on the belief that sustainable tourism could safeguard the future of the surrounding reefs. Designed and managed by Canopy Power, a PV-Storage Hybrid system was installed at Misool in March 2018. Imaged sourced from Canopy Power.

Footnotes

[1] Assuming a diesel price of USD 1 / litre – this varies slightly between countries based on taxes and subsidies, but in the long run is always trending upwards.

[2] One of the biggest factors affecting LCOE is renewable energy penetration (the % that RE contributes to total energy use). This is a design metric that the customer can decide on themselves.

About the author

Having trained in electrical & electronic engineering in England, Daniel Rye spent the best part of a decade “engineering the Internet” before moving to Singapore. Here he decided to map his skills onto renewable energy, initially gaining experience with a local start-up in 2012. Since then he has been immersed in clean technology, eventually founding advisory firm Rynergy in 2017. He now spends much of his time helping to develop remote microgrid projects in Asia with Canopy Power.